Unit Economics: Forgotten term in the Startup Ecosystem?

Closely examining the age-old debate on growth vs profitability for startups

Don’t we all dearly romanticize the announcements of startups raising millions of dollars in private markets at various rounds of financing? More accolades go to the team for securing bigger checks at later stages of funding.

Don’t get me wrong, Easy access to credit is the biggest enabler of innovation in modern society. Flipkart, Paytm, Zomato, Ola, Zerodha, Byju’s, Practo, and countless others have become household names, and rightfully so because of the value they have created for us. These unicorns have achieved roughly 30 years of growth in about 10 years which would have been very hard to do if they were to stay profitable from the get-go.

In the first 3 years, these public SaaS companies spend between 80 to 120% of their revenue in sales and marketing (using venture dollars or other forms of capital to finance the business). By year 5, that ratio has fallen to about 50% where it remains for the life of the business. (source)

“A startup is a company designed to grow fast” - Paul Graham

The bigger question that arises is that the inherent function of a business is to generate profits right? When do we escape the Valuation Game and jump to Value Creation (i.e. being profitable so as to create real value for their shareholders)

The Art of War

Founders often face the trade-off of profitability and growth, and the choice made is all about strategy

Young companies tend to prioritize growth and sacrifice profitability by investing earnings and spare capital back into the business, capturing as much market as possible in hopes of a better return on spent dollars in the long run

When the strategy is profitability, typically in more mature companies, the company spends less money for future benefit and does not have the growth rates it had when they were unprofitable. This is common in the life cycle of a business; they sacrifice profits to grow exponentially, and when the time is right, they switch gears to be profitable and reduce their growth rate

Note: When starting out numbers are minuscule ( eg. very fewer customers ) so growth numbers are huge for instance something like 300% and so on. On maturing it's more of a stable growth. Hence pretty important to understand the context i.e. the stage of a firm when talking about growth

The important factor for investors is whether the company’s strategy of growth at the sacrifice of profits has been, and will continue to be successful

Early valuations are mostly based on future cash flows (DCF model)

Pandemic Macroeconomics

A total of 57 companies in India raised funding of $100 million or more during January-June 2022 as against 48 such firms during the corresponding period last year

Only 3.5% of the startups (2 out of 57) that raised $100 million or more between January and June 2022 were profitable, down from 29.2% at the same time in 2021, according to Venture Intelligence

Record low-interest rates and stimmy checks led to markets being flooded with capital to deploy. A lot of startups used this opportunity to raise funds and increase their runway

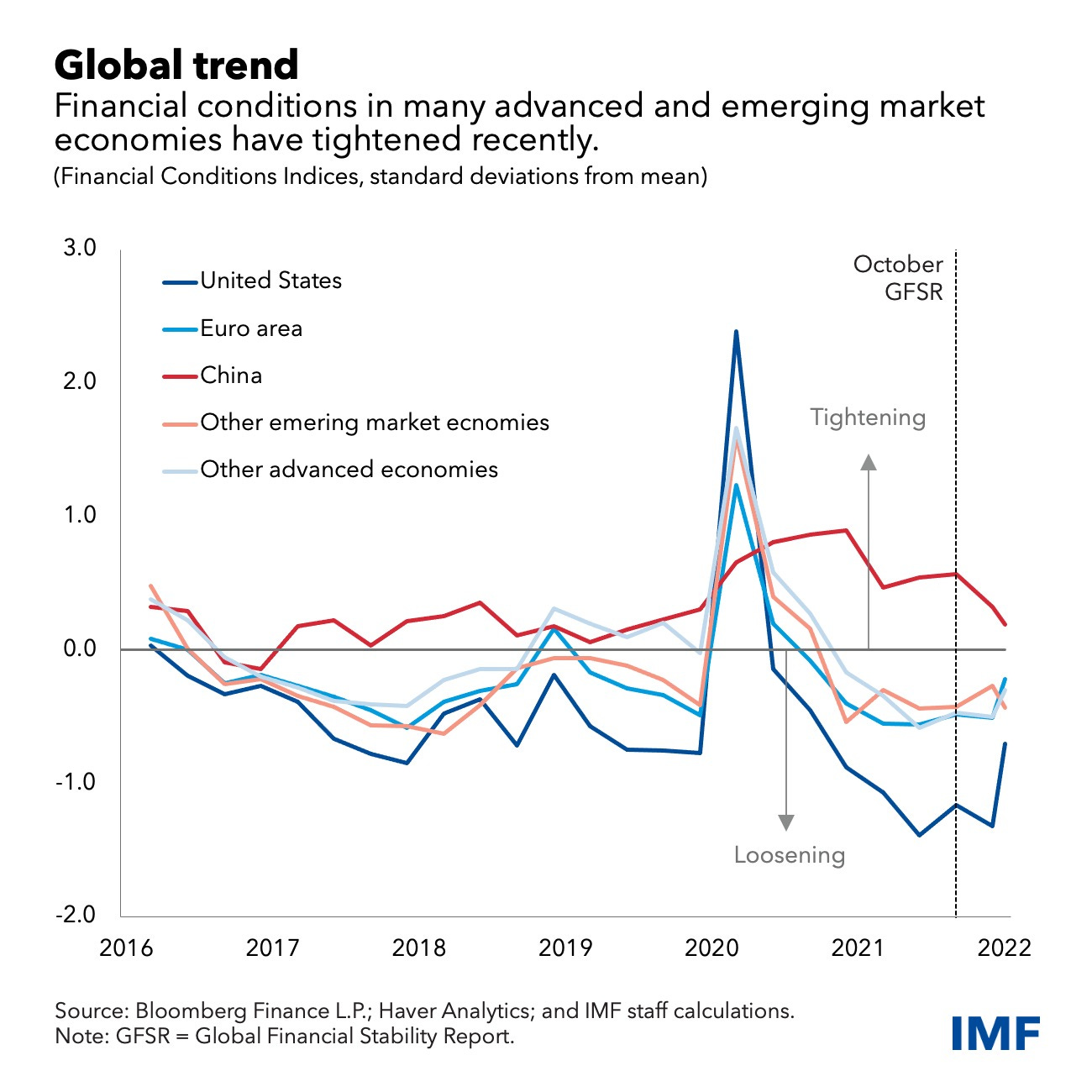

More: IMF Oncoming Funding Winter: At $1.9B, January 2023’s total investments declined from $5.2B in the same month last year, down from $3.2B in December according to Venture Intelligence with more activity moving to early-stage deals

IPO Fiasco

( Covering the US market since it has a lot more Tech IPOs compared to India )

Going public is the holy grail for start-up founders as well as investors. Airbnb, DoorDash, Palantir, Lemonade, and Snowflake all joined the public market in 2020 despite being unprofitable at the time of their IPOs. Uber, Slack underperformed and the collapse of WeWork’s IPO are huge signs of worry

The bigger question that arises is realistically how long till profitability? The aforementioned are not risky startups experimenting in early stages (Pre-PMF in brief), they are huge public corporate giants. At the time of writing this article, Uber’s current market cap is $72.68B, it is still a loss-making business which is nothing less than concerning

If public startups face competitive pressure from public markets and their value goes down ( market corrections due to changing sentiments ) we are in for some major disappointments. In the case of the dot-com crash and the 2008 financial crisis, for instance, companies that launched hot IPOs sometimes saw shares trading below cash value a few months later.

High valuations are only sustainable for those with reasonable business models

Share of companies that were profitable after their IPO in the US from 2008 to 2021: source

Path Ahead

Scaling costs money to become dominant players in respective markets. But losses still say something about a company’s expected trajectory and everyone’s losses are a little different, driven by a mix of expenses and business decisions around marketing spend, margins, and how aggressively to set prices in the interest of gaining market share.

Rather than simply attributing losses to growth, a deeper dive into the aforementioned spending categories as well as expanding into new sources of revenue are needed. Time to revisit Unit Economics ( LTV / CAC ) as well as construct sound business modelsWe never talk about fallen angels who shut down but such instances happen all the time, extending the runway with fresh capital and attempting to decrease burn is a never-ending struggle for founders

M&A deals are already seeing a rise as startups struggle in the prevailing funding winter. The Good Glamm Group, fintech players Cred and Razorpay, edtech player Scaler have been acquisitive while Ola, OfBusiness, and Dream11 are in the process of acquiring companies

If you are an Investor ( VC / Angel ) do leave a comment, I love constructive criticism :) Please reach out to me if this was of value, let's work together and build more of it!

If you are working/building a Startup then feel free to reach out to me for suggestions/collaborations.

This is the second issue of Startup Traphouse, more are already in pipeline. I am pretty active on Twitter, do give a follow at OffWhite_Quant